13 KiB

Executable File

Forecasting Newsletter: October 2020.

Highlights

- Facebook's Forecast now out of out of beta.

- British Minister and experts give probabilistic predictions of the chance of a Brexit deal.

- CSET/Foretell publishes an issue brief on their approach to using forecasters to inform big picture policy questions.

Index

- Highlights

- Prediction Markets & Forecasting Platforms

- In The News

- (Corrections)

- Long Content

- Hard To Categorize

Sign up here or browse past newsletters here. I'm considering creating a Patreon or substack for this newsletter; if you have any strong views, leave a comment.

Prediction Markets & Forecasting Platforms

Facebook's Forecast app now out of beta in the US and Canada.

Hypermind, a prediction market with virtual points but occasional monetary rewards, is organizing a contest for predicting US GDP in 2020, 2021 and 2022. Prizes sum up to $90k.

Metaculus held the Road to Recovery, and 20/20 Insight Forecasting contests. It and collaborators also posted the results of their 2020 U.S. Election Risks Ssurvey.

CSET publishes a report on using forecasters to inform big picture policy questions.

We illustrate Foretell’s methodology with a concrete example: First, we describe three possible scenarios, or ways in which the tech-security landscape might develop over the next five years. Each scenario reflects different ways in which U.S.-China tensions and the fortunes of the artificial intelligence industry might develop. Then, we break each scenario down into near-term predictors and identify one or more metrics for each predictor. We then ask the crowd to forecast the metrics. Lastly, we compare the crowd’s forecasts with projections based on historical data to identify trend departures: the extent to which the metrics are expected to depart from their historical trajectories.

Replication Markets opens their Prediction Market for COVID-19 Preprints. Surveys opened on October 28, and markets will open on November 11, 2020.

In the News

The European Union is attempting to build a model of the Earth at 1km resolution as a test ground for its upcoming supercomputers. Typical models run at a resolution of 10 to 100km.

Michael Gove, a British Minister, gave a 66% chance to a Brexit deal. The Independent follows up by giving the probabilities of different experts

Some 538 highlights:

- US general election polls are generally a random walk, rather than having momentum.

- Pollsters have made some changes since 2016, most notably weighing by education.

- An interactive presidential forecast

New York magazine goes over some differences between 538's and The Economist's forecast for the US election.

Reuters looks at the volatility between the dollar and the yen or Swiss franc as a proxy for tumultuous elections. Reuters' interpretation is that a decline in long-run volatility implies that the election is not expected to be contested.

Meanwhile, new systems for forecasting outbreaks in the American pork industry may help prevent outbreaks, and also make the industry more profitable.

- On the topic of animals, see also a Metaculus question on whether the EU will announce going cage-free by 2024.

Corrections

In the September newsletter, I claimed that bets on the order of $50k could visibly move Betfair's odds. I got some pushback. I asked Betfair itself, and their answer was:

It would definitely be an oversimplification to say that “markets can be moved with 10 to 50k”, because it would depend on a number of other factors such as how much is available at that price at any one time and if anyone puts more money up at that price once all available money is taken.

For example if someone placed £100k on Biden at 1.44 and there was £35k at 1.45, and £57k at 1.44, then around £7k would be unmatched and the market would now be 1.43-1.44 on Biden. But if someone else still thinks the price should remain at 1.45-1.46 they could place bets to get it back to that, so the market will shift back almost immediately.

So to clarify, the bets outlined in those articles aren’t necessarily the sole reason for the market moving, therefore they can’t be deemed the causal connection. They are just headline examples to provide colour to the betting patterns at the time. I hope that is useful, let me know if you need any more info.

Negative Examples

Boeing releases an extremely positive market outlook. "A year ago, Boeing was predicting services market demand to be $3.13 trillion from 2019-2028, making the prediction for $3 trillion from 2020-2029 look optimistic."

Long Content

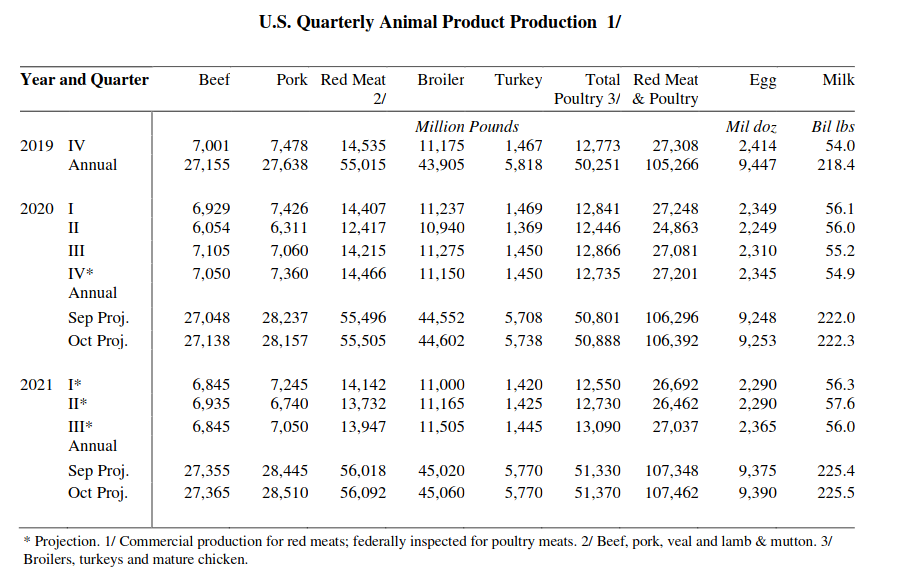

The World Agricultural Supply and Demand Estimates is a monthly report by the US Department of Agriculture. It provides monthly estimates and past figures for crops worldwide, and for livestock production in the US specifically (meat, poultry, dairy), which might be of interest to the animal suffering movement. It also provides estimates of the past reliability of those forecasts. The October report can be found here, along with a summary here. The image below presents the 2020 and 2021 predictions, as well as the 2019 numbers:

The Atlantic considers scenarios under which Trump refuses to concede. Warning: very long, very chilling.

National Geographic on the limits and recent history of weather forecasting. There are reasons to think that forecasting the weather accurately two weeks in advance might be difficult.

Andreas Stuhlmüller, of Ought, plays around with GPT-3 to output probabilities; I'm curious to see what comes out of it. I'd previously tried (and failed) to get GPT-3 to output reasonable probabilities for Good Judgment Open questions.

A 2019 paper by Microsoft on End-User Probabilistic Programming, that is, on adding features to spreadsheet software to support uncertain values, quantify uncertainty, propagate errors, etc.

The 2020 Presidential Election Forecasting symposium presents 12 different election forecasts, ranging from blue wave to Trump win. Here is an overview.

Blue Chip Economic Indicators and Blue Chip financial forecasts are an extremely expensive forecasting option for various econometric variables. A monthly suscription costs $2,401.00 and $2,423.00, respectively, and provides forecasts by 50 members of prestigious institutions ("Survey participants such as Bank of America, Goldman Sachs & Co., Swiss Re, Loomis, Sayles & Company, and J.P. MorganChase, provide forecasts..."). An estimate of previous track record and accuracy isn't available before purchase. Further information on Wikipedia

- Chief U.S. economist Ellen Zentner of Morgan Stanley won the Lawrence R. Klein Award for the most accurate econometric forecasts among the 50 groups who participate in Blue Chip financial forecast surveys.

- I would be very curious to see if Metaculus' top forecasters, or another group of expert forecasts, could beat the Blue Chips. I'd also be curious how they fared on January, February and March of this year.

Hard to categorize.

Scientists use precariously balanced rock formations to improve accuracy of earthquake forecasts. They can estimate when the rock formation appeared, and can calculate what magnitude an earthquake would have had to be to destabilize it. Overall, a neat proxy.

Some superforecasters to follow on twitter.

Dart Throwing Spider Monkey proudly presents Intro to Forecasting 01 - What is it and why should I care? and Intro to Forecasting 02 - Reference class forecasting.

I've gone through the Effective Altruism Forum and LessWrong and added or made sure that the forecasting tag is applied to the relevant posts for October (LessWrong link, Effective Altruism forum link). This provides a change-log for the month. For the Effective Altruism forum, this only includes Linch Zhang's post on Some learnings I had from forecasting in 2020. For LessWrong, this also includes a post announcing that Forecast, a prediction platform by Facebook is now out of beta.

Note to the future: All links are added automatically to the Internet Archive. In case of link rot, go there and input the dead link.

Using actuarial life tables and an adjustment for covid, the implied probability that all 246 readers of this newsletter drop dead before the next month is at least 10^(-900) (if they were uncorrelated). See this Wikipedia page or this xkcd comic for a comparison with other low probability events, such as asteroid impacts.